The cryptocurrency market is known for its volatility. Bitcoin, the most famous cryptocurrency, can swing wildly in value in just one day. This volatility makes it difficult to use cryptocurrencies for everyday transactions. Stablecoins are a new type of cryptocurrency designed to address this issue.

But before you start looking for the best crypto exchange to acquire

USDT tokens, lets explore the inner mechanisms of stablecoins and demystify how they maintain their price peg and what this means for their stability in the volatile cryptocurrency market.

What is a Stablecoin

A stablecoin is a digital currency (cryptocurrency) that attempts to peg its market value to a stable external reference point. This reference point can be a fiat currency (like the US dollar or Euro), a commodity (like gold), or even another cryptocurrency.

By pegging their value to a stable asset (hence the name), stablecoins aim to offer the benefits of cryptocurrency – fast, secure, and borderless transactions – without the wild price swings.

How Do Stablecoins Work

There are three main types of stablecoins, each with a different mechanism for maintaining its peg:

- Fiat-backed stablecoins: These are the most common type of stablecoin. They are backed by reserves of real-world assets, typically held by a regulated financial institution. Every unit of the stablecoin in circulation should have an equivalent amount of the underlying asset held in reserve. For example, a US dollar-backed stablecoin would have $1 in reserve for every unit of the stablecoin outstanding. This reserve system ensures that the stablecoin can always be redeemed for its underlying asset at a 1:1 ratio.

- Crypto-backed stablecoins: These stablecoins are collateralized by other cryptocurrencies rather than fiat currencies. To create a crypto-backed stablecoin, users lock up a certain amount of another cryptocurrency into a smart contract (a self-executing contract on a blockchain). The smart contract then mints an equivalent amount of the stablecoin. The value of the collateral must be greater than the stablecoins outstanding value to maintain the peg. For example, to mint $1 worth of a crypto-backed stablecoin, a user might need to lock up $1.20 worth of another cryptocurrency as collateral. This over-collateralization helps to absorb price fluctuations in the underlying cryptocurrency.

- Algorithmic stablecoins: These stablecoins use algorithms to manage the stablecoin supply in circulation. When the stablecoin price rises above its peg, the algorithm mints new tokens to increase supply and drive the price down. Conversely, when the price falls below the peg, the algorithm burns existing tokens to decrease supply and push the price back up. Algorithmic stablecoins are a complex and relatively new invention, and their long-term stability remains to be seen.

What are the Benefits of Stablecoins

Stablecoins offer several advantages over traditional cryptocurrencies:

- Price stability: Stablecoins provide a more stable medium of exchange than conventional cryptocurrencies. This makes them more suitable for everyday transactions, such as buying goods and services online.

- Faster transactions: Cryptocurrencies can take a long time to settle due to the complex verification process (mining). Some stablecoins can offer faster transaction times compared to traditional cryptocurrencies.

- Access to DeFi: In Decentralized Finance (DeFi), stablecoins act as a key ingredient, enabling users to engage in lending, borrowing, and crypto trading without needing traditional financial institutions.

What are the Risks of Stablecoins

While stablecoins offer some advantages, there are also some risks to consider:

- Peg failure: If the mechanism used to maintain the peg is not robust, the stablecoin could lose its value. For example, a fiat-backed stablecoin could lose its peg if the issuer is unable or unwilling to redeem tokens for the underlying asset.

- Counterparty risk: Fiat-backed stablecoins rely on a trusted third party (the custodian) to hold the reserves. If the custodian is hacked or bankrupt, users may lose their funds.

- Regulatory uncertainty: The regulatory landscape for stablecoins is still evolving. This uncertainty could create risks for businesses and investors.

The Future of Stablecoins

Stablecoins have the potential to revolutionize the way we use digital currencies. They offer a more stable and user-friendly alternative to traditional cryptocurrencies. However, it is crucial to be aware of the risks involved before investing in or using stablecoins.

As the regulatory environment for stablecoins continues to develop, we can expect to see further innovation in this rapidly evolving space.

How to Buy Stablecoins

Buying stablecoins is relatively straightforward, and you can acquire them through various platforms, including cryptocurrency exchanges, peer-to-peer (P2P) platforms, and decentralized finance (DeFi) platforms. Heres a general step-by-step guide on how to buy stablecoins:

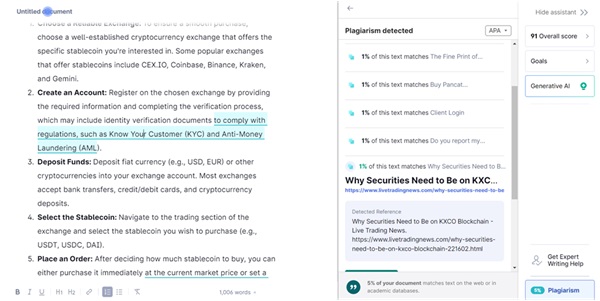

- Choose a Reliable Exchange: To ensure a smooth purchase, choose a well-established cryptocurrency exchange that offers the specific stablecoin youre interested in. Some popular exchanges that provide stablecoins include CEX.IO, Coinbase, Binance, Kraken, and Gemini.

- Create an Account: Register on the chosen exchange by providing the required information and completing the verification process, which may include identity verification documents to comply with regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML).

- Deposit Funds: Deposit fiat currency (e.g., USD, EUR) or other cryptocurrencies into your exchange account. Most exchanges accept bank transfers, credit/debit cards, and cryptocurrency deposits.

- Select the Stablecoin: Navigate to the trading section of the exchange and select the stablecoin you wish to purchase (e.g., USDT, USDC, DAI).

- Place an Order: After deciding how much stablecoin to buy, you can either purchase it immediately at the current price using market order or set a limit order to buy it at your desired price.

- Finalize the Transaction: The stablecoins will be deposited into your exchange wallet once your order executes. For added security, particularly if you plan to hold them long-term or in larger quantities, consider transferring them to a secure software or hardware wallet.

Do Your Homework: Thoroughly research and compare cryptocurrency exchanges before diving in. Prioritize platforms with solid reputations and robust security measures. Additionally, be aware of transaction fees, withdrawal limitations, and any potential tax consequences related to buying and holding stablecoins.

Click here to read full news..